Tenant Concessions – Commercial Real Estate Property

By David Smith

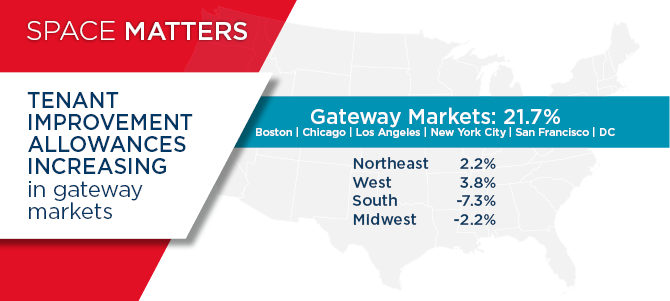

In 2017, increases in concessions were primarily focused in five of the six gateway markets: Boston, Chicago, New York, San Francisco, and Washington, DC. Los Angeles was the only gateway market to see concessions decrease last year. Across all six gateway markets the average tenant improvement (TI) allowance increased 21.7% from 2016 to 2017. In comparison, TI allowances grew by less than 4% in the Northeast and West regions, and actually decreased on average in the South and Midwest.

By the end of 2017, concessions were highest in Midtown Manhattan and Washington, DC, with both markets exceeding $150 psf. The four markets that saw the largest increases year-over-year were all gateway markets: San Francisco and the three Manhattan markets—Downtown, Midtown, and Midtown South. Number five on the list was San Jose/Silicon Valley, which saw an increase of 21% in 2017.

Looking forward, increases in commercial tenant improvements are expected to continue in the gateway markets and spread more broadly to smaller markets across the country. In fact, nearly half of the 42 markets analyzed by Cushman & Wakefield are forecasted to see TI allowances rise in 2018. This will include larger markets like Chicago and San Jose/Silicon Valley, as well as geographically diverse secondary markets such as Cincinnati, Raleigh/Durham, and San Diego.

Occupiers should take advantage of these new opportunities where they can. There is approximately 100 million square feet (msf) of office space currently under construction, which represents 2% of the U.S. inventory. Eight markets have at least 3.5 msf of office space currently under construction, headed by Midtown Manhattan (9.6 msf), Washington, DC (5.6 msf), and Dallas/Fort Worth (5.1 msf). Many markets with construction booms need the space to keep up with demand. However, there are certain markets where supply increases and slowdowns in demand will lead to increases in concessions and decelerating rental rate increases over the coming 18 months.

To learn more about how CRESCO, Greater Cleveland’s leading commercial real estate company, can help you with your property needs, contact us at 216.520.1200, or fill out the form below. A CRESCO professional will contact you shortly.